The Massive Growth Of Uber Eats

Originally Published: finance.nine.com.au, May 31, 2019

At first glance it might appear to be something of a gimmick: you can now order popcorn, choc-tops and snack foods straight from the multiplex to your front door via Uber Eats.

But the move highlights some of the most recognisable brands in Australia going to extreme lengths to recapture revenue lost to online services and competitors in the oversaturated retail sector.

Spotting a growing market of customers willing to pay more for convenience, HOYTS Cinemas, Coles and BP service stations have all made the unlikely shift to Uber Eats.

To compete with Netflix, HOYTS is now delivering candy bar food online (Supplied)

To compete with Netflix, HOYTS is now delivering candy bar food online (Supplied)

The cinema franchise is now offering delivery on items from its candy bar on Uber Eats across 32 locations nationwide.

“We’re thrilled to partner with Uber Eats to extend the full menu to snack-lovers across Australia, so they can enjoy their favorite menu items at home,” a spokesman told nine.com.au.

BP added customers would already come to them for convenience and the latest move only added to their ability to service demand.

“We recognise the changing habits of our consumers, with millennials in particular regularly using Uber Eats for greater convenience,” a spokesman said.

“We are incrementally adding new locations for ‘Couchfood’ where we see customer demand for a wide range of snack foods, which customers can conveniently order from the comfort of their couch.

“We are already seeing some fan favourites being regularly ordered, such as Tim Tams.”

Retail consultant Roger Simpson the push was about recognisable brands seeking new sources of revenue to remain competitive in the retail sector.

“As retail is becoming so competitive stores are looking at ways to attract and retain their customers,” he said.

“Coles has seen Aldi take a fair chunk of its market share so it needs to look at ways to sell products in areas it hasn’t done before.

“It’s the same with HOYTS. It can Uber popcorn to customers who are watching movies on Netflix.”

BP has also found its way onto Uber Eats. (AAP)

BP has also found its way onto Uber Eats. (AAP)

Mr Simpson said service stations and cinemas on Uber Eats might just be the tip of the iceberg.

“For those retailers that can attract new customers through Uber Eats deliveries, this is a good strategy as it provides incremental revenue,” he said.

“As more and more big players take to this platform, it will put pressure on others to follow.”

He added the trend for convenience has extended past delivery, with Coles overhauling 100 supermarkets in the coming six months to stock more ready-to-eat food and semi-prepared meals – a move that follows the lead of Woolworths’ small format Metro stores.

Data from the National Association of Convenience Stores confirms people are less concerned for a full pantry, instead opting to pay a premium for quick and easy meals.

The report found a 16th straight year of record in-store sales for convenience stores across the US in 2018 – total sales surged 8.9 per cent to $A950 billion.

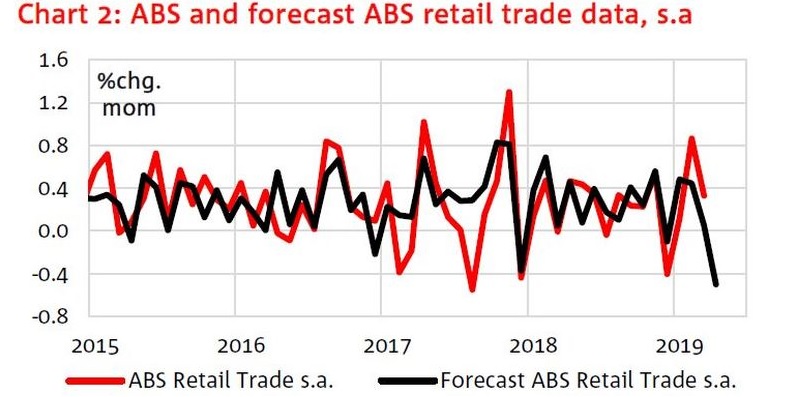

“The value of convenience has never been higher,” the report read. The push from HYOTS, BP and Coles comes as National Australia Bank’s data mapping has delivered the weakest forecast for the cashless retail sales index in half a decade.

NAB’s cashless retail sales index suggests Australian retail sales plunged in April. (Supplied)

NAB’s cashless retail sales index suggests Australian retail sales plunged in April. (Supplied)

NAB Chief Economist Alan Oster said the bank forecast ABS retail trade will fall 0.5 per cent a month on month basis for the month of April.

“This is clearly a very weak result, which further underlines our broader concerns about the Australian economy,” he said.

“While trading and profitability have previously dipped below average, April is the first time the employment index has shown signs of weakness.

“This does not bode well for consumer sentiment or retail sales.”

Mr Simpson contributed the poor results to large brands and online retail making it very hard for bricks-and-mortar companies to compete as efficiently as they once could.

“Unfortunately, a lot of retailers seem to think trying to win on price is the way to go, but it’s very hard to compete with some of the big players who have deep pockets,” he told nine.com.au.

Continue the story online with Matthew Dunn on Facebook and Twitter.